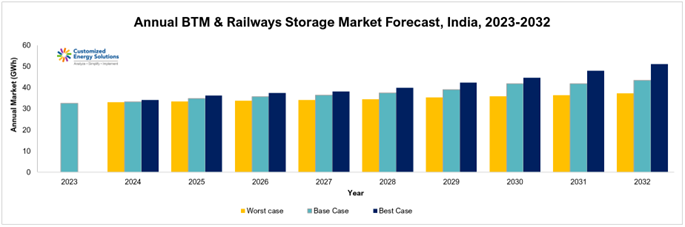

India's Behind-The-Meter (BTM) energy storage market, currently at 33 GWh in 2023, is poised for significant expansion, with projections indicating growth to over 44 GWh by 2032. This upsurge is primarily driven by the demand in the telecom and UPS sectors. Central to this growth narrative is the rising adoption of lithium-ion technology, marking a pivotal shift from traditional lead-acid batteries.

Key Trends in the market:

- BTM Storage market is driven by the power reliability issues faced by the electricity consumers in the country. The majority of the battery applications here are for power backup e.g.: inverters, UPS, Telecom towers, and off-grid solar.

- Lead acid batteries dominate all the key market segments of BTM. LiB penetration is highest in the telecom sector (up to 60%) presently, it is expected to be the largest contributor till 2032. Other technologies likely to enter this market are Sodium –ion, Vanadium flow, Zinc Bromide and Aluminum Air batteries.

- The UPS segment is poised for increased demand in Li-ion chemistry driven by the booming data center market. Pushed by a need for low footprint, longer operational life solutions, LiB demand in UPS sector stood at 1500 MW in 2023, with a projected 10% CAGR from 2023 to 2032.

- The rooftop solar battery market, with 2 GWh of installations, is steadily growing at 7%. There was a trend towards li-ion batteries in 2023, primarily in the C&I segment for niche and tailored applications.

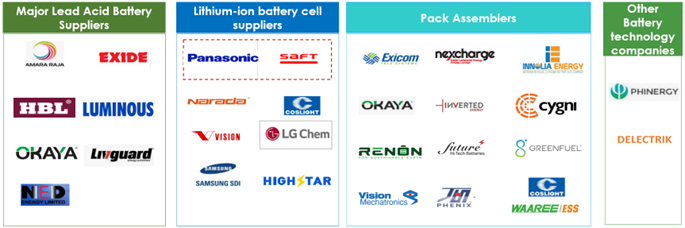

- Several players are planning to enter lithium battery manufacturing in the country namely Exide Industries, Reliance New Energy, Amararaja, Livguard and others, with capacities ranging from 1 GWh to 20 GWh. This contains both EV and stationary pack suppliers. There are over 30+ notable pack assemblers for li-ion batteries across Gurgaon, Noida, Gujarat, Maharashtra, Delhi, Himachal Pradesh, Tamil Nadu, and Telangana.

- As the market matures, the adoption of lithium-ion batteries is expected to increase beyond niche applications to more widespread use in commercial, and industrial energy storage systems. This transition is facilitated by the declining cost curve of lithium-ion technology, making it increasingly competitive against traditional storage solutions.

Key Battery Suppliers to BTM Applications

What is covered in the report?

- Annual energy storage market demand (GWh) in BTM, railway segment, rural and de-centralised installations and how it has changed from 2022 to 2023.

- Market forecast (GWh) by applications till 2032 – rooftop solar + storage, telecom tower back up, inverter battery backup, UPS battery backup, energy storage for decentralised and rural electrification, and railway application.

- Key players and their market shares in lead-acid battery market for BTM application

- Key players in the lithium-ion and other advanced chemistry battery market for BTM applications.

- Price -trend of Lithium-ion battery packs till 2032.