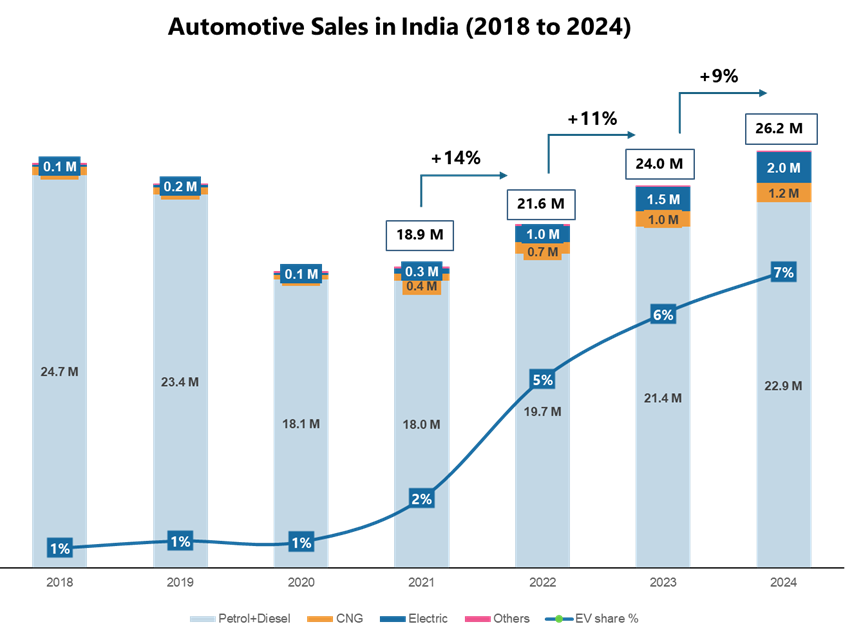

India’s automotive industry is at a turning point, with the electrification wave reshaping not just vehicles but entire ecosystems. While petrol and diesel powertrains continue to dominate, 2024 marked a critical shift in market dynamics, where electric vehicles (EVs) achieved a 7% share of the 26.2 million domestic vehicle sales. This reflects a growing consensus across OEMs, governments, and consumers that zero-emission mobility is no longer a distant goal but a rapidly emerging reality.

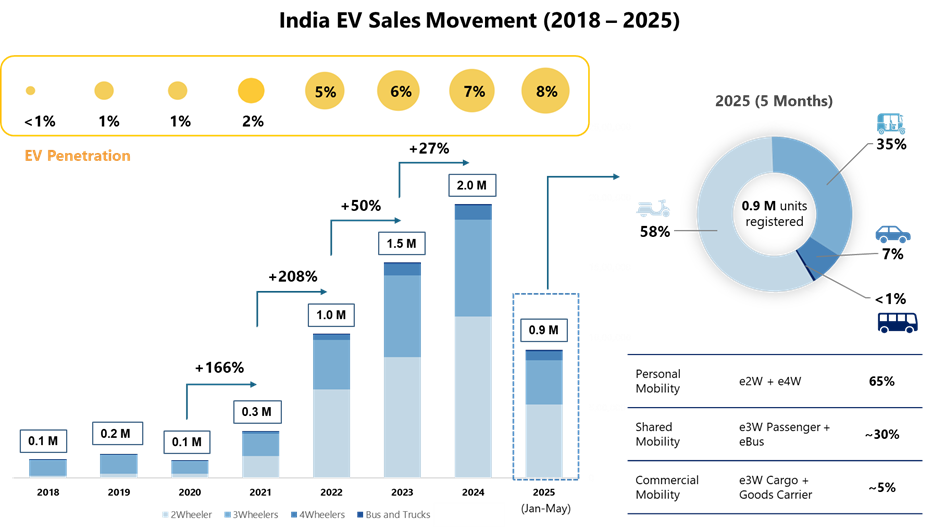

During 2018, India’s auto market hovered around 25 million units, but declined due to the impact of COVID and widespread supply chain disruptions. During the recovery phase, India witnessed an accelerated shift toward alternative fuels, particularly electric vehicles, alongside CNG, hybrids, and other low-emission technologies. EV penetration, which remained below 1% until 2020, began to rise rapidly in response to favourable policies, infrastructure expansion, and growing OEM commitment. From 2% in 2021, EV sales increased steadily, reaching 5% in 2022, 6% in 2023, and an estimated 8% by May 2025.

What makes India’s transition unique is its multi-fuel, multi-path approach. Alongside battery-electric vehicles, there is visible traction in compressed natural gas (CNG), hybrid, flex-fuel, and even hydrogen mobility. Electrification is advancing fastest in light vehicles, while alternate fuels remain dominant in segments like Heavy and long-haul freight. This heterogeneity reflects both the complexity and maturity of the Indian mobility landscape.

Segment Overview: Electrification Across the Vehicle Spectrum

Electric vehicles have maintained strong growth momentum in recent years. Between January and May 2025 alone, EV sales reached 0.9 million units, representing an 8% share of the overall vehicle market. Segment-wise, two-wheelers and three-wheelers contributed the bulk of these sales, accounting for 58% and 35%, respectively. Recent policy developments and government announcements suggest a clear focus on boosting electrification in shared mobility and commercial vehicle segments through targeted incentives and infrastructure support. Going forward, these sectors are likely to receive increased attention and backing to accelerate adoption.

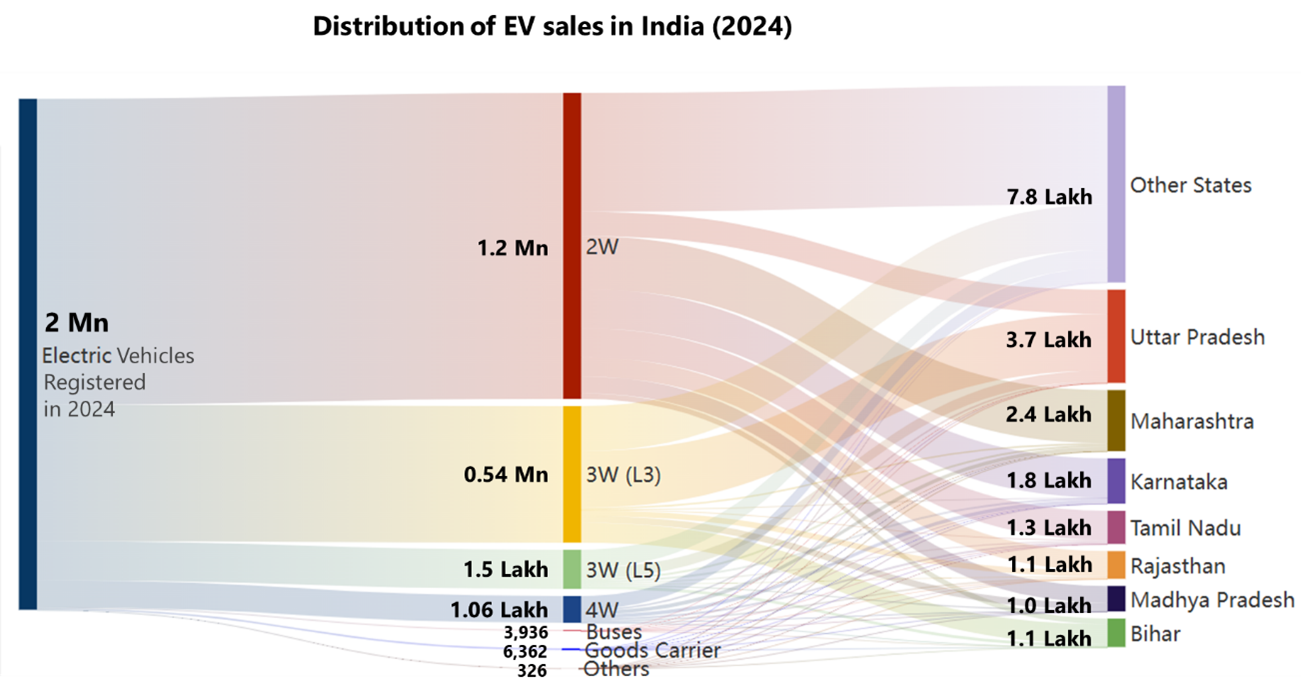

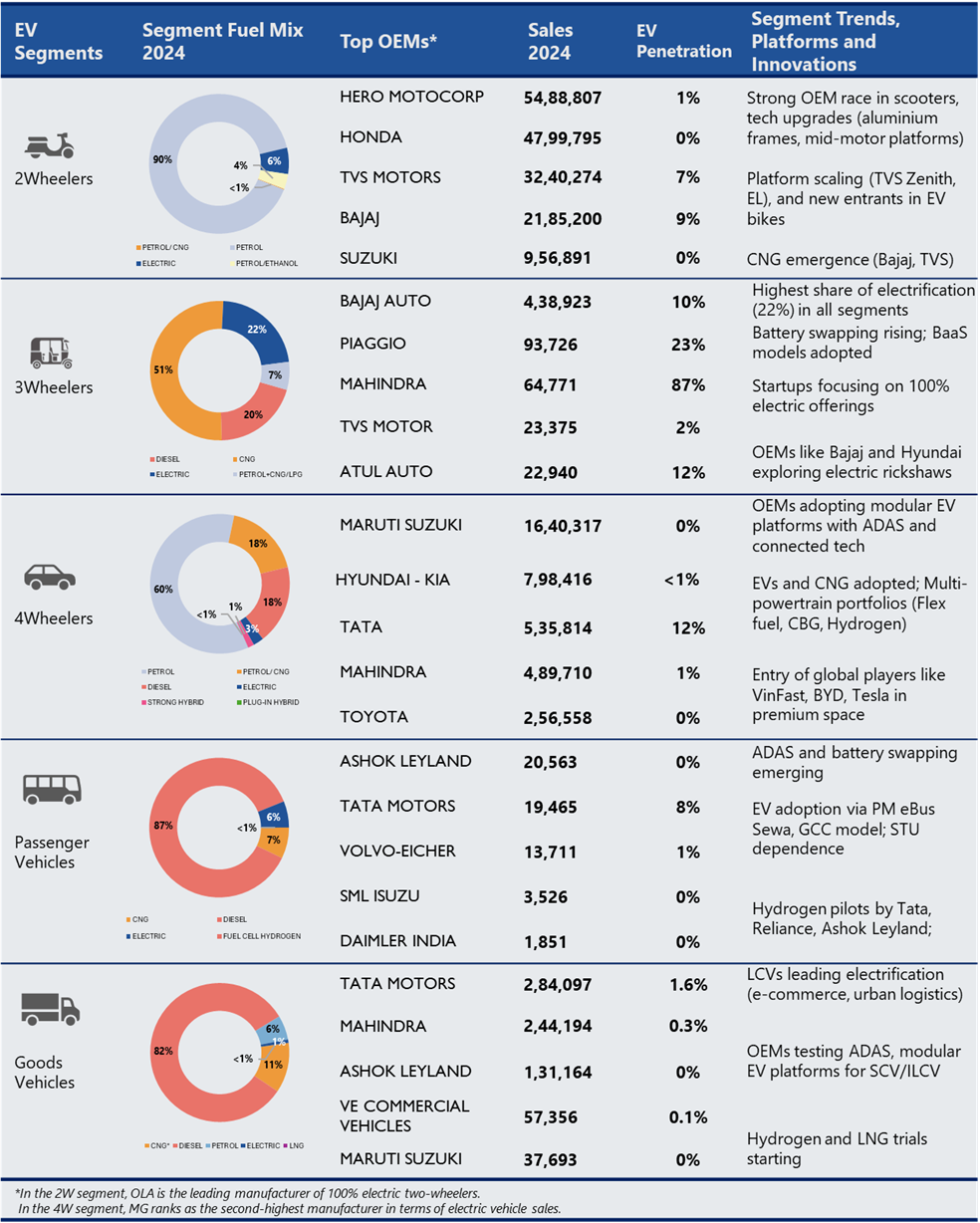

The rise of EVs in India is led overwhelmingly by two-wheelers (2Ws), which accounted for over 1.2 million electric units in 2024, roughly 6% of total 2W sales. This growth is concentrated among a few players, with the top 10 OEMs commanding 94% of the e-2W market. Consumers and e-commerce users are increasingly attracted to these vehicles for their lower running costs and enhanced range, particularly in urban and semi-urban markets.

Three-wheelers (3Ws) are experiencing the fastest pace of electrification growth, especially in the high-speed L5 category. In 2024, over 6.8 lakh L5 three-wheelers were sold, with electric variants making up 1.5 lakh of them. This 22% share is up from 13% the previous year, driven by last-mile delivery demand from e-commerce, pharma, and retail sectors. Notably, CNG models maintained a 50% share, while diesel models declined further. Most state and central policies are now designed to incentivize adoption in the 2W and 3Ws space through subsidies, manufacturing-linked incentives, and infrastructure support.

Four-wheelers (4Ws) lag in EV penetration at 2.5%, due to price, limited models and highway charging infrastructure. The recent announcements from OEMs in this space with newer models of higher travel range, higher warranty and better financial models are going to boost this segment. Petrol powertrain remains dominant, followed by CNG and diesel. EV sales crossed 1 lakh units in 2024, with significant contributions from Tata, MG, Hyundai, and new premium entrants.

Electric buses are seeing strong uptake under government procurement programs like the PM e-Bus Sewa. Around 4,000 e-buses were sold in 2024, primarily for intra-city operations. States like Delhi, Maharashtra, and Karnataka led registrations. Goods carriers, particularly light commercial vehicles (LCVs), are also embracing electrification. With sales doubling in 2024, OEMs are rolling out models tailored for urban logistics, supported by fleet network and fast charging.

Regionally, EV adoption is highly uneven. States like Uttar Pradesh, Maharashtra, Karnataka, and Tamil Nadu dominate electric vehicle sales, accounting for over half of national volumes. Uttar Pradesh leads in e-3W adoption, especially in L3 and L5 categories, while Maharashtra and Karnataka show strong performance in both e-2W and e-4W segments. Tamil Nadu has emerged as a manufacturing and export hub, supporting a diverse EV mix. Conversely, smaller northeastern states like Assam and Tripura show traction mainly in commercial EVs, while several northern hill states lean toward electrified goods and passenger carriers rather than personal EVs due to the high torquey nature of the vehicle better for hauling.

Electrification is primarily concentrated in light commercial and private vehicles, and pilot projects for hydrogen-powered vehicles are gaining attention in the heavy-duty goods and passenger transport segment, traditionally dominated by diesel. Petrol vehicles remain prevalent in light motor vehicles (LMVs), especially cars and two-wheelers. Meanwhile, Alternate Fuel Vehicles (AFVs) including CNG, hybrids, bi-fuel, and other low-emission options are increasingly adopted in LMVs and light goods vehicles, signalling a broader shift in the fuel mix

This shift, however, is not uniform across states. Some regions are advancing directly to Zero Emission Vehicles (ZEV) adoption, driven by proactive EV policies, manufacturing ecosystems, and investment in infrastructure. Other States are progressing through a phased path, relying more on AFVs to bridge the gap. This multi adoption approach from States reflects varied levels of market maturity, readiness, and local priorities.

OEM strategies moved beyond individual EV models to integrated platforms, diversified fuel portfolios, and ecosystem partnerships. Tata Motors’ acti.ev platform and Mahindra’s INGLO architecture exemplify this trend, offering modular, scalable solutions with high-range batteries and digital connectivity. Maruti Suzuki and Hyundai are also preparing dedicated platforms targeting mass-market and premium segments.

OEMs are hedging their bets with parallel investments in flex-fuel, CNG, and hydrogen. Bajaj’s launch of the world’s first CNG motorcycle, TVS and Honda’s flex-fuel trials, and hydrogen pilots by Tata and Ashok Leyland highlight a diversified approach to decarbonization. These efforts are not just stopgaps but part of a broader strategy to reduce emissions while EV infrastructure scales.

Battery localization is another cornerstone. Ola’s gigafactory with current capacity of 1.4 GWh, Tata Group’s Agratas gigafactory, Amara Raja’s tie-up with Piaggio, JSW-MG Battery-as-a-Service (BaaS) model, and Mahindra’s BaaS collaboration with Vidyut signal growing vertical integration. With India aiming to become a global battery manufacturing hub, these investments are aligned with long-term supply chain resilience.

The premium EV segment is also heating up. Global entrants like BYD, Tesla, and VinFast are targeting high-income urban consumers, while domestic players like Mahindra and Tata are expanding into aspirational EV categories. Across the board, OEMs are embedding advanced driver-assistance systems (ADAS), 5G connectivity, and OTA updates, making vehicles smarter and more connected.

Government Initiatives and Policy Support

India’s evolving EV market is supported by Government policies with a balanced emphasis on both demand and supply-side interventions. On the demand front, the government has implemented targeted subsidy programs to reduce upfront costs and encourage adoption particularly in utility-focused segments. The FAME-II scheme played a foundational role in supporting electric vehicles adoption since 2019. More recently, the PM e-Drive scheme, launched in October 2024 with an allocation of ₹10,900 crore, aims to expand adoption further. It focuses on electric two-wheelers, e-three-wheelers for last-mile cargo and passenger transport, and the electrification of trucks and buses used in inter- and intra-city operations. Additionally, the scheme allocates funding to upgrade vehicle testing infrastructure, enabling readiness for emerging technologies such as Advanced Driver Assistance Systems (ADAS) and CASE (Connected, Autonomous, Shared, and Electric) applications.

On the supply side, the government is backing domestic manufacturing through the PLI-Auto scheme, which supports the production of Advanced Automotive Technology (AAT) components, and the PLI-ACC (Advanced Chemistry Cell) program, which promotes large-scale battery cell manufacturing to localize energy storage systems. Further, the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI), introduced in 2024, incentivizes global OEMs to establish manufacturing bases with reduced import duties, subject to investment and local value addition commitments. Together, these initiatives are laying the groundwork for a self-reliant, innovation-driven EV manufacturing ecosystem.

The Road Ahead: Uneven but Unstoppable

These policy and manufacturing advances have helped build critical momentum, especially in the two-wheeler and three-wheeler segments, which are now setting the pace for broader electrification across passenger cars, buses, and commercial fleets. With a strong pipeline of upcoming EV models, rising levels of battery localization, and a more mature regulatory environment, the foundation for a scalable and sustainable EV ecosystem is taking shape.

The next leg of growth will depend on three key enablers: robust charging infrastructure, targeted state-level interventions, and cost parity with ICE vehicles. Pilot projects on Hydrogen mobility and Battery-as-a-Service models could also emerge as high-impact solutions in commercial and long-haul segments.

India’s automotive decarbonisation story is not led by one choice, but by a diversified set of environmentally friendly options driven by OEM strategies tailored to segment dynamics and market maturity. Manufacturers adopted platform-based engineering, multi-fuel portfolios, and strategic localization to respond to both regulatory shifts and evolving consumer demand. India is driving toward a cleaner, multi-path future—where innovation, regulation, and infrastructure will determine the pace of progress.