India’s Journey to 500 GW Non-Fossil Fuel Capacity: Storage as the Backbone

In 2021, at the COP26 Summit, India announced its goal to achieve 500 GW of non-fossil fuel-based energy capacity by 2030 aligning with its Nationally Determined Contributions (NDCs) under the Paris Agreement. In its updated 2022 NDCs, India committed to reducing emissions intensity of GDP by 45% from 2005 levels and ensuring 50% of total electricity capacity comes from non-fossil sources by 2030. The 500 GW target is central to achieving these climate objectives.

The Role of Energy Storage in a Renewable-Driven Grid

A large share of the 500 GW will come from variable sources such as solar and wind, which are weather dependent and intermittent. To manage this variability and maintain grid reliability, large-scale energy storage like battery energy storage systems (BESS) and pumped hydro is essential. Storage enables excess renewable energy to be stored and used when generation is low or demand is high, supporting a more stable and renewable-heavy grid. With renewables projected to reach 32% of the energy mix by 20301 (up from 13.8% in October 20242), storage becomes a vital buffer beyond traditional solutions like energy banking.

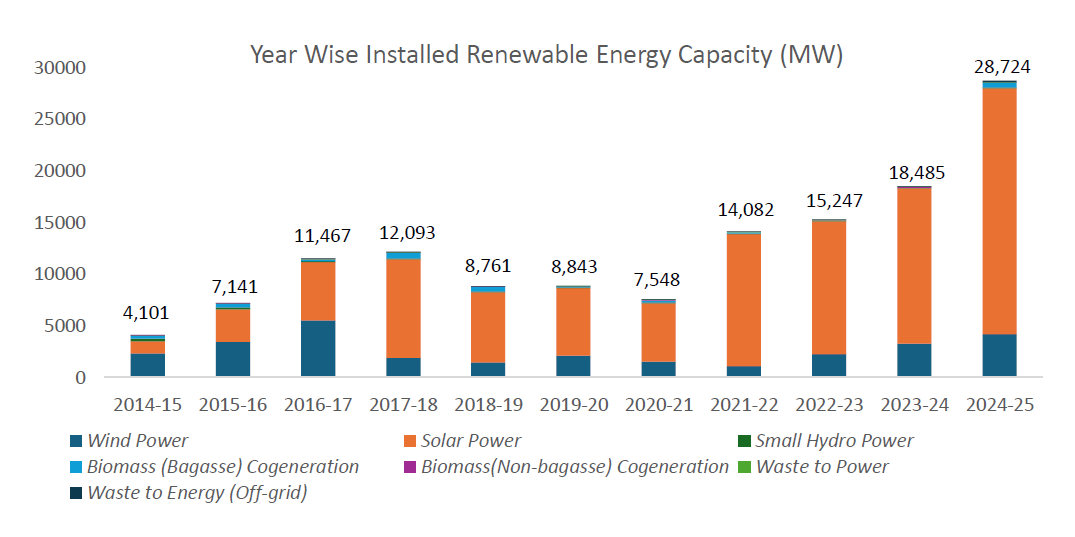

Exponential Growth in Renewable Installations

As of April 2025, India had 220.1 GW of non-fossil fuel electricity capacity.3 In 2024 alone, India added ~30 GW of capacity, an increase of 113% over 2023, indicating strong progress toward 2030 target. Of this, cumulative installed RE capacity (excluding large hydro) stood at 175 GW, a significant 390% rise from 35.85 GW in 2014. In April 2025 alone, ~3.3 GW of new RE capacity was commissioned with solar leading the mix, followed by wind, highlighting India’s rapid clean energy transition and the growing need for storage solutions.

Fig.1 Installed Renewable Energy Capacity (MW) (Excluding Large Hydro Power) (Year wise Achievements)

Source: MNRE

Note: above capacity excludes large hydropower projects

Energy Storage as a Critical Enabler

Given the increasing share of renewable energy, the need for energy storage has become more critical than ever. Energy storage serves as a key enabler for renewable integration, ensuring power quality, frequency regulation, and grid stability. By absorbing excess electricity during peak generation hours and supplying it during periods of low generation or high demand, storage helps reduce curtailment, optimize generation costs, and maintain continuous power supply. This functionality is not just limited to environmental benefits; it also plays a crucial role in ensuring energy security and resource adequacy especially in the face of increasing electricity demand from electric vehicles, urbanization, and industrial growth.

Government Initiatives and Policy Support

Recognizing this need, the Government of India has taken several proactive steps to promote the energy storage sector. As outlined in the National Electricity Plan (NEP) 2023, India is projected to require 411.4 GWh of energy storage capacity by 2031–32. Of this, 236.22 GWh is expected to come from BESS, while 175.18 GWh is anticipated from pumped storage projects. To accelerate deployment, the government has introduced a Viability Gap Funding (VGF) scheme to support the development of 13.5 GWh of BESS by 2030–31. Out of this, 12.1 GWh of capacity has already been issued until April 2025, with financial assistance covering up to 30% of capital costs. In parallel, MNRE also focusing on inviting bids for 50 GW of renewable energy capacity each year from FY 2023-2024 till FY 2027–28.4 This initiative is designed to drive growth across the electricity ecosystem including generation, transmission, distribution, and storage infrastructure.

To further accelerate the deployment of energy storage systems in India, the Government of India has introduced several supportive policy measures. For instance, in January 2025, the Central Electricity Authority (CEA) issued an advisory mandating all future solar projects to incorporate a minimum of 2-hour co-located ESS, equivalent to 10% of the project capacity, to enhance grid stability and support peak demand. This directive could lead to the addition of 14 GW/28 GWh of energy storage capacity by 2030, signalling strong policy support for co-located BESS deployment.

In addition, several other national-level initiatives have been rolled out to support BESS growth, including:

o Waiver of ISTS charges for standalone BESS and renewable energy + storage projects commissioned before June 30, 2025.

o Model bidding guidelines issued by the Ministry of Power (MoP) in 2022 and updated in 2023, encouraging firm and dispatchable renewable energy (FDRE) tenders to include storage.

o CERC’s Ancillary Services Regulations (2022), which allow BESS to participate in frequency regulation and reserve capacity markets.

o State-level energy storage mandates requiring storage in RE procurement plans.

o Manufacturing incentives through the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) batteries.

o Resource adequacy planning, where states are now required to consider firm capacity from BESS and pumped storage projects (PSPs) in their long-term planning.

Several states have also included energy storage in their RE Policies. Madhya Pradesh introduced its Pumped Hydro Storage Scheme 2025, which facilitates development through four different modes and offers incentives such as electricity duty waiver on pumping power and a 50% waiver on wheeling charges for five years. Complementing this, the Madhya Pradesh Renewable Energy Policy 2025 provides additional benefits like 100% exemption from electricity duty for 10 years and land-related concessions to storage project developers.

Similarly, Telangana’s Clean & Green Energy Policy 2025 targets the deployment of 11,722 MW of ESS by FY35. The policy promotes both BESS and PSP by granting deemed non-agricultural status to project land, 100% stamp duty exemption, and electricity duty waivers. For battery manufacturing units, a capital subsidy of 20% (capped at INR 30 crore) is also available.

Apart from Madhya Pradesh and Telangana, several other states are promoting energy storage through dedicated policies. For instance, under the Andhra Pradesh Integrated Clean Energy Policy 2024, the state aims to develop 25 GW of BESS and 22 GW of PSP capacity, positioning itself as the storage capital of the country. The Uttarakhand Solar Policy 2023 encourages solar-plus-storage solutions, offers capital subsidies for behind-the-meter (BTM) ESS, and provides exemptions from transmission and wheeling charges.

The Rajasthan Renewable Energy Policy 2023 outlines specific targets for energy storage, including minimum storage requirements, Renewable Purchase Obligation (RPO) benefits, and a focus on R&D and manufacturing. The Odisha Renewable Energy Policy 2022 promotes renewable energy projects with integrated storage, offers incentives for BESS and PSP, and prioritizes hybrid projects with storage components.

Under the Uttar Pradesh Solar Energy Policy 2022, the state emphasizes solar capacity addition with ESS and encourages R&D in energy storage technologies. The Karnataka Renewable Energy Policy 2022 focuses on ensuring round-the-clock (RTC) power using energy storage and aims to create a market for developing ESS capacity to support the expansion of renewable generation.

The Maharashtra Unconventional Energy Generation Policy 2020–2025 targets the development of 50 MW of storage by 2025, encourages solar-plus-storage EV charging stations, and offers land and loan-related benefits. Lastly, the Tamil Nadu Solar Energy Policy 2019 highlights the use of energy storage systems to meet solar targets, with projects to be developed by either TANGEDCO or private players.

To support these goals, each of these states has issued several energy storage tenders in the recent past. Such progressive policies are playing a critical role in accelerating the adoption and growth of energy storage systems across India.

Despite Progress, India Remains Far from Achieving its BESS Deployment Target

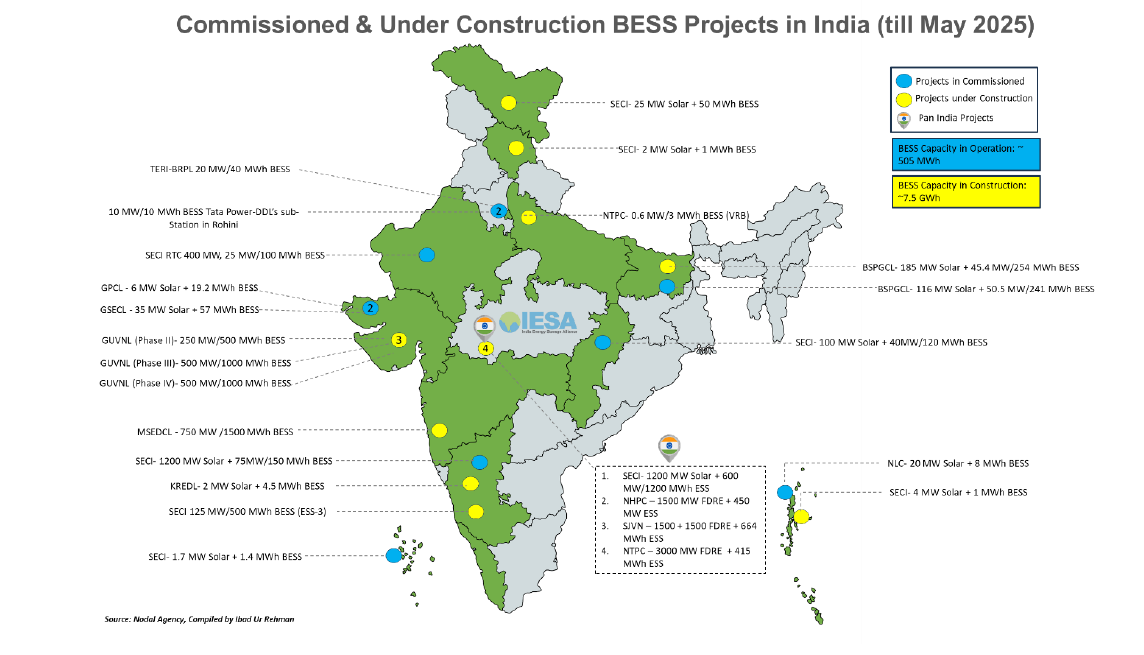

As of April 2025, only about 0.5 GWh of BESS capacity has been commissioned. However, momentum is building. In the first quarter of 2025 alone, more than 9 GWh of standalone BESS tenders were floated by central and state agencies such as NTPC, GUVNL, NVVN, and TGGENCO. Overall, more than 100 GWh of energy storage projects comprising both BESS and pumped storage are currently in the pipeline. In addition to the 0.5 GWh of operational capacity, around 7.5 GWh of BESS capacity is under construction and is expected to be operational by late 2026 or early 2027. A further 50 GWh of projects are in the tendering stage and may begin construction by the end of 2026 or early 2027.

Fig.2 Commissioned and Under Construction Projects in India (Until May 2025)

Source: IESA

The Road Ahead: Scaling to Meet the 2031–32 Target

In the best-case scenario, India could reach approximately 60 GWh of operational BESS capacity by 2027 roughly one-quarter of the 2031–32 target. To stay on track, India must add at least 30 GWh of BESS capacity every year from now until 2029. This requires not only sustained policy and financial support but also expansion of domestic manufacturing capabilities, stronger private sector participation, and innovative business models such as hybrid renewable-plus-storage power purchase agreements and storage-as-a-service models.

Challenges in BESS Tenders and the Impact of Falling Tariffs in India

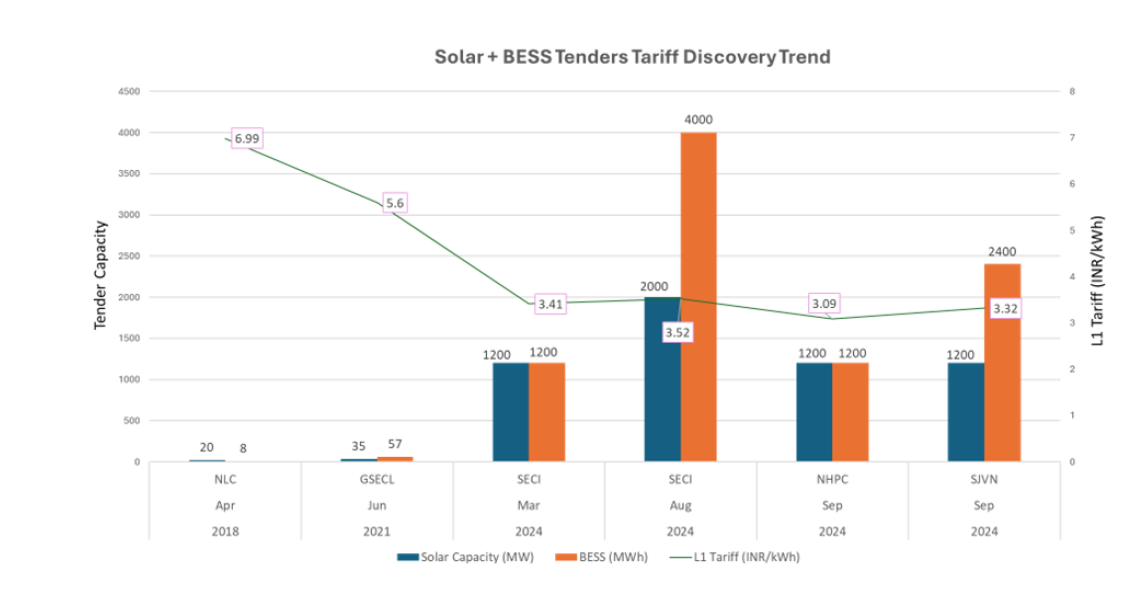

Over the past few years, government authorities have issued several BESS tenders both as standalone projects and combined with solar power. However, recent trends show growing concerns from industry stakeholders about the direction in which these tenders are heading.

Fig.3 Solar + BESS Tenders Snapshot (2018-2025)

Source: IESA

One of the main issues is the rapid and significant fall in discovered tariffs. In Solar + BESS tenders, the L1 tariff has dropped from around INR 6.99/kWh in 2018 to INR 3.09 in 2024 and 3.32/kWh in 2025, even as the battery capacities being tendered have increased significantly.

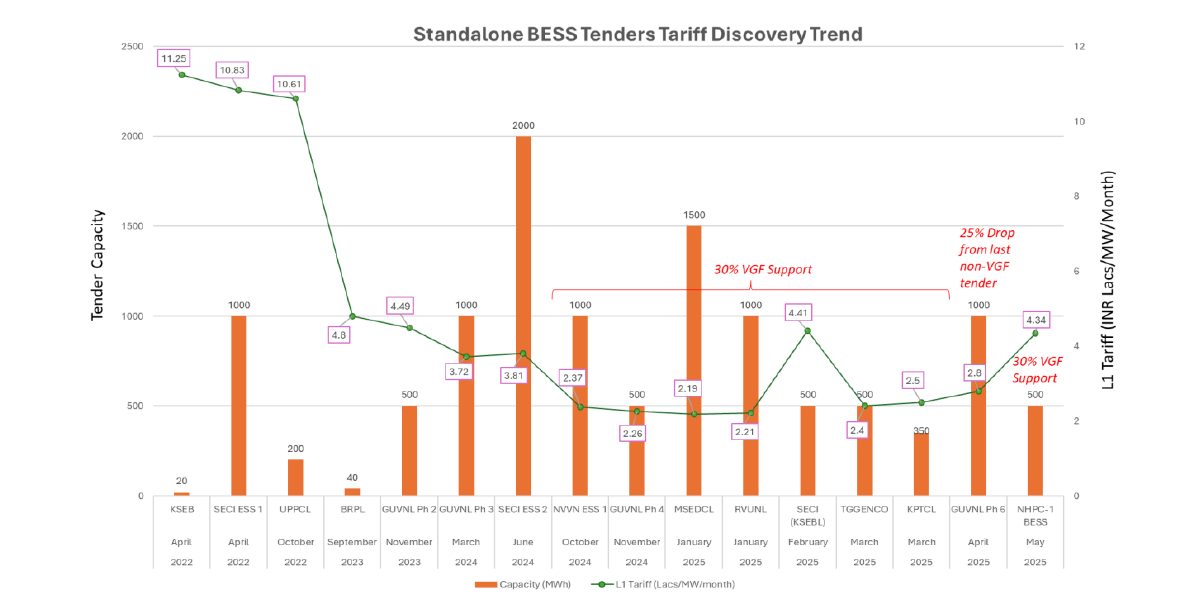

Similarly, in standalone BESS tenders, the monthly tariff has dropped from INR 11.25 lakh/MW in 2022 to as low as INR 2.19–2.4 lakh/MW by early 2025. This represents a 75% drop in just three years, despite increased storage penetration and stricter resource availability requirements. These record-low tariffs may seem like a positive development at

first glance, but many industry players warn that these numbers are not backed by sound cost calculations or operational plans.

Fig.4 Standalone BESS Tenders Snapshot (2018-2025)

Source: IESA

While competitive bidding is essential for market development, the recent trend of record-low tariffs has raised concerns about project viability. In some cases, bids appear to lack alignment with the actual cost structures and operational realities of large-scale BESS projects. This misalignment has occasionally resulted in execution delays, contractual complications, or even re-tendering. These challenges underline the need for a more balanced approach that encourages both cost-effectiveness and project bankability.

Recently, a few tenders faced issues post-award and tariff adoption, including the GUVNL 1000 MWh tender and the SECI ESS-1 tender with a capacity of 2000 MWh. Key reasons for these issues include non-fulfilment of project requirements and other compliance gaps.

Beyond aggressive bidding, there are structural issues in the way tenders are being designed. The financial and technical eligibility criteria are not strict enough to filter out inexperienced or unprepared bidders. The earnest money deposits (EMD) and bank guarantee (BG) requirements are also relatively low compared to the size and complexity of these projects. This increases the risk of project failure after award. In addition, many tender documents often lack standardized technical parameters, making it harder to compare bids and enforce quality. There is also confusion around the GST structure and input credit, and no clear requirement for end-of-life battery disposal, both of which can affect project economics and long-term safety.

Given the current situation, there is an urgent need to revise tender criteria. Key suggestions include:

o Limiting capacity allocation for first-time bidders, with future eligibility based on actual performance.

o Standardizing technical specifications such as cycle life, depth of discharge (DoD), degradation limits, and safety certifications.

o Supporting the indigenization of BESS components (excluding battery cells) to boost local manufacturing.

o Adopting a Quality and Cost-Based Selection (QCBS) method instead of purely L1-based selection, giving importance to quality and technical strength.

Without these changes, the current bidding process may continue to attract participants who prioritize winning over actual execution. While low tariffs may look appealing in the short term, they are not sustainable and may harm the long-term growth of the energy storage sector. A well-designed, transparent, and performance-driven tender system is essential for India to meet its energy storage goals with reliable and bankable projects.

A Glimpse of Pumped Storage Projects of India (PSP)

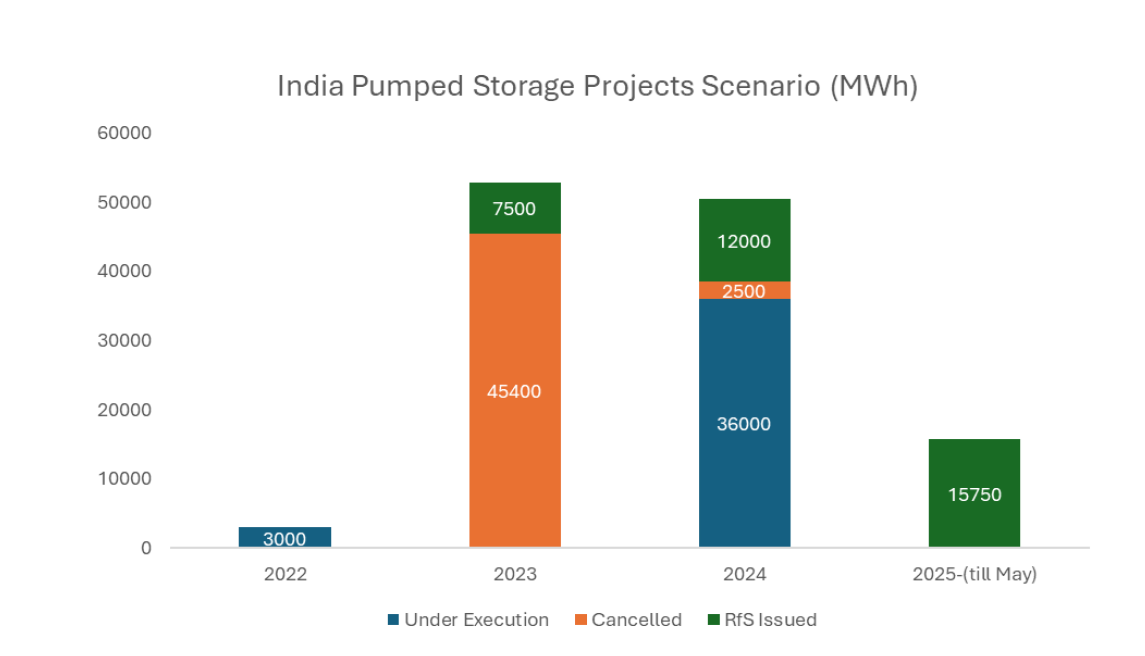

Pumped Storage Projects (PSPs) are an essential component of India’s long-duration energy storage strategy, particularly to address the variability associated with renewable energy sources such as solar and wind. As of May 2025, approximately 122 GWh of PSP capacity has been announced by various central and state authorities. However, around 31.5 GWh of this capacity has been cancelled, while 39 GWh is currently under execution. An additional 35.2 GWh is in the tendering stage. In 2025, two new PSP tenders have been issued—one by Uttar Pradesh Power Corporation Limited (UPPCL) for 12 GWh and another by Adani Electricity Mumbai Limited (AEML) for 3.75 GWh.

Fig.5 Pumped Storage Projects (PSPs) in India (Until May 2025)

Source: IESA

According to the National Electricity Plan (NEP) 2023, India is projected to require 175.18 GWh of pumped storage capacity by 2031-32. The cancellation of a significant portion of announced capacity highlights several challenges that are inhibiting the sector's progress. These include high upfront capital costs, limited financial incentives or government support, extended construction timelines, and uncertainty in early-stage revenue streams.

To address these constraints and encourage the development of PSPs, it is recommended that VGF be extended to cover pumped storage projects. While VGF is currently available for BESS, its inclusion for PSPs could enhance project bankability by offsetting part of the capital expenditure, thereby improving financial viability and investor confidence.

PSPs demand considerable initial investments for infrastructure development, including the construction of upper and lower reservoirs, installation of reversible turbines, and grid connectivity upgrades. These projects typically require 5 to 10 years for commissioning and may take decades to generate full economic returns. Such long development and payback periods pose challenges for attracting private investment, which generally favors quicker returns.

Despite these barriers, PSPs offer substantial advantages. They provide a range of grid services such as load balancing, frequency regulation, peak demand management, and ancillary services and are well-suited for supporting renewable energy integration. Unlike BESS, PSPs do not rely on critical minerals, many of which are currently imported, making

them a more resource-secure option for India. Furthermore, PSPs typically offer a longer operational lifespan and lower levelized cost over their lifecycle.

Given these attributes, PSPs represent a technically and economically viable solution for meeting India’s long-duration energy storage requirements. Extending financial support mechanisms such as VGF, along with establishing clear revenue models, can improve project feasibility and facilitate greater private sector participation. This will be essential for ensuring the timely development of PSPs and achieving India's broader energy transition and grid reliability goals.

Conclusion: Energy Storage as the Foundation of India’s Clean Energy Future

Energy storage lies at the heart of India’s clean energy transformation. Without robust storage solutions, the country cannot realistically achieve its 500 GW non-fossil capacity target by 2030, nor its net-zero vision by 2070. Storage is no longer just a supporting technology it is the backbone of a modern, resilient, and low-carbon energy system. With strategic planning, technological innovation, and stakeholder collaboration, India has the potential to become a global leader in both renewable energy and energy storage. The journey has begun, but accelerated action will be essential to realize this vision.

References

1. India’s RE Power Rise: Renewable Share Reaches 13.85% in 2024

2. India’s renewables share in Grid by 2030

3. MNRE- India’s Renewable Energy Capacity Achieves Historic Growth in FY 2024-25

4. Government decided to invite bids for 50 GW of renewable energy for the next 5 years

5. India adds record renewable energy capacity of about 30 GW in 2024

6. Installed Renewable Energy Capacity (MW) (Excluding Large Hydro Power)-MNRE